PE/VC investments slow down in 2016 after scaling a peak in 2015

New Delhi: Private equity (PE) and venture capital (VC) investments in India dropped sharply in 2016 after hitting a peak in 2015, both in terms of volume and value.

PE/VC investments worth about $16.2 billion were recorded in 2016 across 591 deals, against $19.6 billion across 767 deals in 2015. This was a decline of 18% in terms of deal value and 23% in terms of deal volume year-on-year, as per data provided by EY.

The decline was largely on account of lower investments in the e-commerce sector (from $4.2 billion in 2015 to $1.5 billion in 2016 and 188 deals in 2015 to 93 deals in 2016), the data showed.

“Overall, the year was a mixed bag. Despite the expected decline in the e-commerce investments, PE investments in 2016 were close to the earlier peak achieved in 2007. Also, the deal volumes remained the second highest ever after the 2015 peak,” said Mayank Rastogi, partner and leader for private equity at EY.

“Positive notes included the step change in investments by Canadian investors, increase in buyout activity, sustenance of the VC activity despite the hit to e-commerce sector, strong PE portfolio company IPOs etc,” he added.

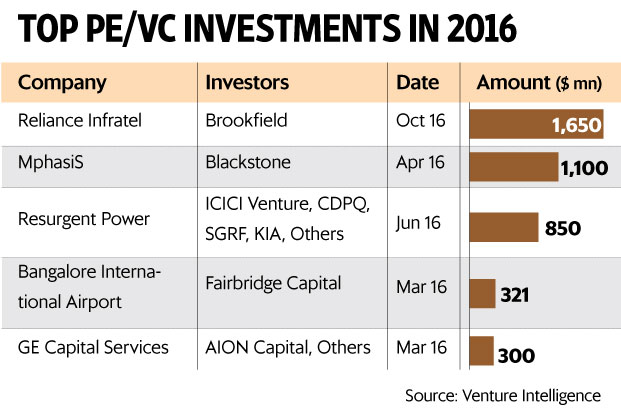

Here is the list of top five PE/VC investments in 2016:

Reliance Communications-Brookfield Infrastructure ($1.65 billion)

Reliance Communications Ltd (RCom) on 21 December entered into a binding agreement with Brookfield Infrastructure Partners to sell its tower business. RCom claims the deal is the largest investment by a foreign investor in the Indian infrastructure business. Its telecom towers will be demerged into a separate company that will be wholly owned and managed by Brookfield Infrastructure.

RCom is also merging its wireless business with smaller rival Aircel and has said the deal will help reduce its leverage as it transfers part of its debt to the new venture.

RCom plans to use the proceeds from upfront payment for the tower unit and the money from the Aircel deal to reduce its debt by 60% to about Rs17,000 crore. The firm will hold a 50% stake in the wireless business with Aircel and 49% in non-voting shares in the tower business.

Blackstone-Mphasis ($1.1 billion)

Blackstone India, the Indian arm of global PE fund Blackstone Group L.P on 4 April, agreed to acquire a 60.5% equity stake in Bengaluru-based IT services provider Mphasis Ltd from Hewlett Packard Enterprise (HPE) at Rs430 per share.

Both HPE and Blackstone agreed on the terms of a master services agreement (MSA) for five years with three automatic renewals of two years each. Under this MSA, HPE has proposed to commit a minimum revenue amount escalating year-on-year and totaling $990 million over the next five years. Mphasis will also be included in HPE’s preferred provider programme, opening up significant additional revenue opportunities, the company had said previously.

Resurgent Power-ICICI Venture ($850 million)

ICICI Venture Funds Management Co. Ltd on 10 September picked up a 10% equity stake in Resurgent Power Ventures (RPV), a power platform created to facilitate investment in power projects in India by ICICI Group and Tata Group. The platform will raise an initial capital of $850 million. Tata Power is the strategic partner with 26% stake and will provide operations and maintenance services to assets acquired by the platform. Caisse de dt et placement du Quebec (CDPQ) of Canada, Kuwait Investment Authority and State General Reserve Fund of Oman are the other investors in the platform.

GVK Power-Fairfax India ($321 million)

GVK Power and Infrastructure Ltd agreed on 28 March to divest a 33% stake in Bangalore International Airport Ltd (BIAL) to India-born Canadian billionaire Prem Watsa’s Fairfax India Holdings Corp. and Fairfax Financial Holdings Ltd to reduce its debt. The transaction reduced GVK’s stake in the airport to 10%.

On completion of the deal, GVK Power and Infrastructure’s debt will decline by Rs2,000 crore and its interest costs will drop by some Rs300 crore a year.

GVK Airport Developers, a subsidiary of GVK Power and Infrastructure, initiated a financing process last year to reduce its debt obligations. BIAL owns and operates the Kempegowda International Airport in Bengaluru under a 30+30 year concession agreement from the Indian government.

AION Capital Partners-GE Capital ($300 million)

AION Capital Partners Ltd, an India-focused special situation fund, along with former senior executives of GE Capital Pramod Bhasin and Anil Chawla, agreed 1 September to acquire the commercial lending and leasing business of GE Capital in India.

AION is an India-focused fund established by an affiliate of Apollo Global Management, LLC together with ICICI Venture Funds Management Co. Ltd. The AION Fund with approximately $825 million in committed capital is currently one of the largest private equity funds in India.

Bhasin was the founder of Genpact and is former chief executive of GE Capital India and Asia; Chawla is the former head of GE Capital’s Commercial business and DE Shaw India.

Comments

Post a Comment