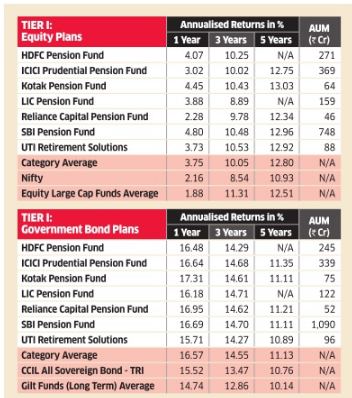

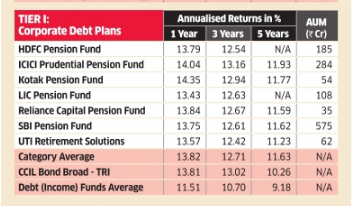

NPS outshines MFs, benchmark indices in 2016

MUMBAI: The National Pension System (NPS) has managed to generate decent returns in 2016. Although its equity plans remained lacklustre, it was compensated by a good performance by the government bond plan and the corporate debt plan. If one assumes an asset allocation of 50% equity , 25% government bond and 25% corporate debt, the average NPS returns for 2016 work out to be 9.47%, better than any other competing products. The product may continue to outperform in 2017 as well, as the year is expected to be challenging for equities.

“2017 is going to be a volatile year and equity schemes managed conservatively like NPS will do better,“ says Anil Rego, Founder & CEO, Right Horizons.

The NPS was able to outperform its benchmarks and also similar mutual fund schemes. For example, the average one-year returns for the equity plan is 3.75%, higher than 2.16% generated by the benchmark index, Nifty , and 1.88% by the large-cap equity funds. Similar pattern is visible with the government bond plan and the corporate debt plan (see table for details).

All NPS managers are well-known fund managers and therefore beating the benchmark index by them is be a big deal. But beating the category average returns by similar mutual fund schemes is the real surprise.

So, what are the reasons for this outperformance? Everyone agree that the NPS' low-cost structure (much lower compared to mutual funds) is the main reason for this. “In addition to the lower expense ratio, better fund management is also a reason for this outperfor mance,“ says Sumit Shukla, CEO, HDFC Pension Funds.

Ramganesh Iyer, cofounder, Fisdom, also concurs with this view.

“Most good mutual fund groups are also managing the NPS. The category average return in mutual funds is based on performance by 40 asset management companies and the average is pulled down by the laggards“, he says.

Tight regulation by the PFRDA by asking asset managers to maintain low risk level has also contributed to the good performance. “However, the NPS may also underperform in a bull market,“ says Ankur Kapur, Founder of Plutus Capital.

So, should you go for NPS? Since it is a long-term product with lock-in till retirement, this decision depends on several other factors. For example, the NPS is not a pure tax-savings insrument like PPF or ELSS, but a taxdeferment scheme because the final corpus becomes taxable.

Comments

Post a Comment